There have been a number of recent reports from analysts who track venture funding in the UK.

Ascendant Corporate Finance (www.ascendant.co.uk) works with growing companies who use technology as the key driver of their business, and has been advising tech companies on transactions for over 20 years. Ascendant recently published its Q2 2020 Page One Tech Report, which can be downloaded in full from its website.

Beauhurst (www.beauhurst.com) is a data platform which tracks the UK’s fastest-growing companies, and aims to include every equity deal. Beauhurst recently published its Equity Investment Market Update H1 2020, which again can be downloaded from the website.

KPMG Private Enterprise’s Global Venture Pulse Survey is published quarterly, using figures from Pitchbook which for the UK do not have the same depth or range as those from Ascendant and Beauhurst.

Statistics from these three organisations are based on different criteria, and cannot be directly compared:

- Ascendant includes only VC and other institutional funding in technology companies, and excludes life sciences and some other sectors. Its figures include VC deals in the Republic of Ireland, but exclude deals under £500k

- Beauhurst includes deals from all sectors and from all types of investor, but its published reports exclude deals which have not been announced in the public domain (although it includes undisclosed deals on its platform, using information from Companies House and other sources)

- KPMG’s figures are restricted to investments by VC firms.

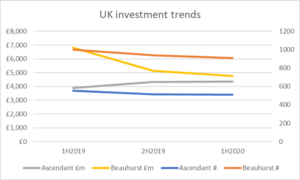

For the UK as whole, all three commentators see a decline in deals and amounts invested in Q2 2020, which Stuart McKnight of Ascendant dubs the ‘coronavirus quarter’, but nothing like what had been feared. According to Ascendant, the market slowed from a particularly busy Q1, 17% by volume and 22% by value. KPMG has similar figures, showing a decline of 25% by volume but just 7% by value (possibly affected by some high value life sciences deals included in the KPMG figures but not in Ascendant’s). Beauhurst’s published reports give numbers for half years rather than quarters (the reports include charts showing quarterly trends), and show just a 3% drop in deals numbers from H2 2019 to H1 2020, and a 7% drop in amounts invested.

While emphasising the differences in criteria for the data from each organisation, it is possible to calculate half year figures from Ascendant’s report and show these trends graphically together with those from Beauhurst:

It is not possible to use KPMG’s published figures to see trend for more than one quarter to another, as figures for previous quarters are revised vey substantially from one report to another.

The authors of these reports make a number of points about the trends:

Ascendant (Q2 compared with Q1):

- Average deal sizes held up

- But 51% of deals were less than £2m in value, and secured only 5% of the totals invested

- London’s share of the VC money was 77% of all the funds invested in the UK and Ireland

Beauhurst (H1 2020):

- Despite the decline in investment – 30% below the top of the market in H1 2019 – H1 2020 was still the fourth highest level of funding in any half year recorded by Beauhurst

- The number of companies completing deals for the first time has been in decline since the beginning of 2018, but dropped by a further 15% in H1 2020

- H1 2020 was the best half in Beauhurst’s records for megadeals (investments over £50m). According to Beauhurst’s Henry Whorwood, this is because, despite coronavirus, there are more investable businesses than ever before, and more capital looking for a home then ever before.

Venture equity investment is very highly concentrated in companies in the south east of England, and while the trends outlined above have some resonance in Scotland, in effect the market here is not only much smaller but also different in structure. There are fewer VCs active in Scotland than in the south east, and megadeal in Scotland is more likely to be £5m+ rather than £50m+. KPMG reports a total of 22 VC deals in Scotland in Q2 2020, 6% of the UK total 355. According to KPMG, this was however an increase of four deals from the previous quarter, and they report an increase of investment from £32m in Q1 to £62m in Q2; this includes the £44m investment in NodThera (see separate report in this issue), which they define as an Aberdeen company, but which is now based in Cambridge with no Scottish connections.

The early stage investment environment in Scotland is dominated by business angel groups, which make many more deals than VCs (although at lower average amounts). As reported in the lat two issues of YCF, Scottish angel groups have maintained investment levels throughout the ‘pandemic quarter’ – in the financial year to end March 2020 deals led by these groups surpassed £100 million for the first time, and investment in H1 2020 increased in value by 95% from H1 2019.

All these reports mentioned above collect and report data in different ways, but they all help give a picture of the trends in the sector. A consensus appears to be that the decline in investment is much less than anticipated, and that there are hopeful signs for investment levels in the UK to hold up, and even start climbing upwards again.

Related Posts

YCF Diversity Data Report – 2018-2023

Presentations from the YCF Conference 2023

Some thoughts on the Scottish Ecosystem for start-ups and spin-outs – 25 years on